With modern design and the power of Windows, the 10bii Financial Calculator makes it easy to quickly find the answers to your financial questions. And now with the release of the new Windows version, the power of the 10bii Financial Calculator is available on every device in your home and office! Bond calculations are performed on the 10bII+ in the Bond menu. Data or settings are stored in the ten keys which make up the top two rows of the keyboard. The functions used in bond calculations are printed in blue above the keys. The table below lists the keys used in bond calculations. HP 10bII+ Financial Calculator (NW239AA) Make sure this fits by entering your model number. HP 10BII+ Financial Calculator. The HP 10bII+ is the smart choice for business and finance needs. You'll be able to work quicker and more efficiently with over 100 time-saving, easily-accessible business. This HP calculator has an intuitive keyboard layout, and minimal keystrokes are required for many common functions. It also offers an easy-to-read display with a 12-digit capacity, adjustable contrast and on-screen labels. This HP 10bII+ Financial Calculator is permitted for use on SAT, PSAT/NMSQT and College Board AP tests. HP 10bII+ Financial Calculator Whether you are a student or a practicing professional, the fast and powerful HP 10bll+ makes it easy to solve business, financial, statistical, and math calculations accurately and quickly, at a price that everyone can afford.

In finance and commercial real estate it’s simply expected that you know how to use a financial calculator. Yet, it’s surprising how many commercial real estate and finance professionals still don’t know how to properly use a financial calculator. Sometimes it’s because they didn’t learn it correctly the first time, and other times it’s because they simply forgot how to use a financial calculator to perform a less frequently used calculation. It’s also common for people to get stuck with basic but confusing settings such as the payments per year setting.

In this article we’ll solve all of these problems by taking a deep dive into how to use a financial calculator. We’ll discuss everything you need to know about getting started, we’ll cover some routine calculations, and we’ll also tackle some common mistakes and misconceptions.

What’s The Best Financial Calculator to Use?

If you’re just getting started, the first choice you’ll need to make is which financial calculator to actually use. Here are the most popular financial calculators used in commercial real estate and finance today:

- HP 10BII. This is one of the newer Hewlett Packard models and is widely used in business schools as well as in the finance industry. HP also produces the HP 10BII+ which includes some minor improvements and some more advanced functionality such as probability distribution calculations. The colors are also slightly different. However, the layout and the core calculations for math and the time value of money are the same and everything covered in this article will also apply to the HP 10BII+.

- TI BA2 Plus. This is one of the newer and most popular Texas Instrument financial calculators and is also widely used in business schools and the finance industry.

- HP 12C. This is one of the older Hewlett Packard financial calculators. It’s not used much in business schools today but it’s still has a strong following among seasoned veterans. Usually the people wielding this small machine have been running financial calculations longer than most of us young(er) professionals have been alive.

Other financial calculators include the HP17BII, the HP19BII, and the HP20b. These financial calculators are not widely used in finance and commercial real estate and therefore are not recommended.

If you’re just starting out it’s really a toss up between the HP 10BII and the TI BA2 Plus. In a survey of the PropertyMetrics audience the HP 10BII was the most popular financial calculator used, so for the purposes of this article we’ll be focusing on the HP 10BII. If you’d like us to cover another model in a future article, let us know in the comments.

As an aside, both the HP 10BII and the TI BA2 Plus have excellent emulator apps for iOS and Android devices.

Why You Need to First Master The Time Value of Money

Before diving into how to use a financial calculator, you must first master the time value of money. The time value of money is a fundamental building block in finance and commercial real estate. A financial calculator is simply a tool that facilitates time value of money calculations. So, before learning how to use a financial calculator, it’s critical to first master the logic and intuition behind the time value of money.

Time value of money is the economic principle that a dollar received today has greater value than a dollar received in the future. What’s the intuition behind this principle? Why does money have time value? What are the components of all time value of money problems? These are all great questions and unfortunately outside of the scope of this article. For a more in depth look at the logic and intuition behind the time value of money, check out What You Should Know About The Time Value of Money.

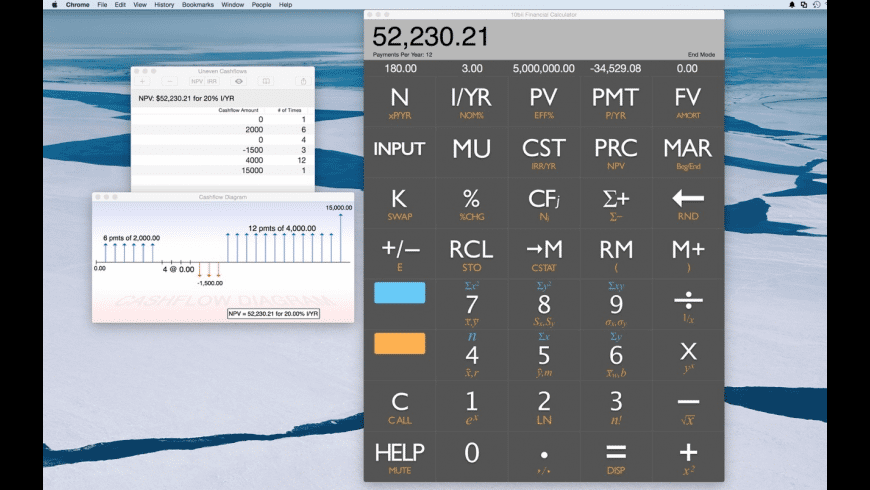

How the HP 10BII Financial Calculator is Organized

Assuming you’re comfortable with the time value of money, let’s next get familiar with the layout of the HP 10BII financial calculator.

Basic Math Functions

Hp Financial Calculators

The most frequently used buttons will certainly be the math keys. These math keys work just like they do on a regular non-financial calculator. All of the other fancy-looking keys might make things confusing at first, but these math functions should make you feel right at home. As you can see these are easy to find and we have clearly labelled this section in red below.

Time Value of Money Functions

The time value of money keys are located along the top of the calculator and correspond to the 5 components of all time value of money problems (N, I, PV, PMT, and FV). We’ll cover how to use these keys in more detail below, but here’s where these keys are located on the HP 10BII:

Gold and Purple Keys

You probably already noticed the solid purple and gold keys. These frequently used keys are needed to shift through different functions for the same key. If you look closely at the other keys on the financial calculator you’ll notice that they have white letters, gold letters, and purple letters.

The white letters are the primary functions, while the gold and purple letters indicate alternative functions for the same key. You can use any of these alternate functions at any time by simply pressing the appropriate shift key (gold key for example) and then pressing the function key with the gold label that you want to use. We’ll demonstrate this process below, but here’s where these keys are located in case they didn’t already stand out to you:

How to Use Basic Functions and Settings

Now that we have a general feel for how the financial calculator is organized, let’s go over some frequently used functions and useful settings you should understand.

How to Turn Your Financial Calculator On and Off

Turning the HP 10BII on and off is pretty simple. All you have to do is use the ON Button to turn it on or the Gold Key first then the ON button to turn it off. Notice the gold text on the ON button, which indicates this is a secondary function for the same button that needs to be preceded by the Gold key.

How to Clear All Registers

As you work through different problems on your financial calculator, one of the easiest ways to make a mistake is to not clear out your existing work from other problems. The clear all function will immediately clear out all of your prior work so you can start a new problem with a clean slate. To accomplish this all you need to do is simply press the Gold key followed by the C key.

How to Use The Plus and Minus (+ / – ) Sign Key

A common task when using a financial calculator, especially when working with the time value of money functions, is changing the sign of a number. The HP 10BII makes this easy with a dedicated plus and minus ( + / – ) sign key, which toggles the sign of an inputted number. To change the sign of a number on the HP 10BII, simply input or calculate a number, then hit the +/- key as shown below:

How to Use The Memory Register

There are a couple of different ways to store and recall numbers on the HP 10BII. First, we’ll go over the memory register key, which just stores one value at a time. To use the M register, simply input or calculate a number, then hit the M register key as show below. To recall a value stored on the M register, simply press the RM or recall memory key:

How to Store and Recall Multiple Values From Memory

If you want to store multiple values then you’ll need to use a different approach. This is particularly useful when you are calculating multiple figures that then later need to be used in a final calculation. To do this you’ll need to use the store and recall key as shown below:

To store a number using this approach, use the following procedure:

- Input or calculate a number

- Press the gold key

- Press the STO key

- Press a number (0-9) where you’d like to store the value

This is a straightforward process on the HP 10BII but it does involve a lot of steps that can be cumbersome and sometimes annoying. This is one area where the TI BA2 Plus offers a much faster and simpler solution since the store and recall keys are two separate buttons (no extra shift key is required). The TI BA2 Plus is outside of the scope of this article, but if you’ll be storing and recalling multiple numbers like this on a regular basis, then you’ll probably like the TI BA2 Plus better.

Recalling a stored value is a lot easier:

- Press the RCL button

- Press a number (0-9) where you previously stored a value

How to Use A Financial Calculator Online Course

A complete online course that teaches you how to use an HP 10BII financial calculator step-by-step with easy-to-follow videos and commercial real estate specific examples

- Learn the HP 10BII financial calculator step by step

- No prior finance knowledge required

- Includes a complete time value of money crash course

- Includes commercial real estate specific problems and solutions

How to Use The Time Value of Money Keys

Now that we have a good understanding of how the HP 10BII financial calculator is organized and we’ve also gone over some regularly used functionality, let’s dive into the time value of money. This is, after all, what a financial calculator is built for.

Assuming you’re comfortable with the concepts of the time value of money (in particular the 5 components of all time value of money problems), the time value of money keys on the 10BII are very intuitive to use. The best way to master using the time value of money keys on the 10BII is to simply practice. Below we’ll go over how to use each of the 5 keys individually and also go over some practice problems. But first, lets discuss how to avoid a common mistake people make when using a financial calculator.

Consistency of The Time Value of Money Components

One of the most common problems people make when using a financial calculator is inputting inconsistent time value of money components. When solving for time value of money problems it’s critical that the frequency of the N, I, and PMT components match. For example, if the number of periods (N) in the problem is monthly, then the interest rate (I) and payments per period (PMT) must also be expressed monthly.

The HP 10BII financial calculator has a built in settings for payments per year that attempts to auto-adjust the interest rate based on how many periods there are in a year. However, this does not auto-adjust the N and PMT components (you still have to do this manually), which makes this function cause more problems than it’s worth. For this reason it’s better to set payments per year to 1 and then totally ignore this setting. You’ll need manually adjust the components in each problem so that they match in frequency, but this will result in fewer errors. You can set the payments per year setting to 1 by simply pressing the 1 key, then the gold key, and finally the PMT key.

So, assuming you have your financial calculator set to 1 payment per year and you’ve cleared all registers, let’s go through some example problems to demonstrate how to use the time value of money functions on the HP 10BII financial calculator.

Solve for Present Value on the HP 10BII

Let’s take a look at a present value problem and then solve it with the HP 10BII.

A U.S. savings bond will be worth $10,000 in 10 years. What should you pay for it today in order to earn 6.5% annually?

To solve this time value of money problem let’s take a look at the 4 variables that we know. We are given the future value FV of $10,000, the number of periods N is 10 years, and the rate I is 6.5% per year. There is no payment and both the rate and the number of periods are consistent, so we can now solve for the unknown present value PV, which is $5,327.

To do this on the HP 10BII, first clear all prior work, and then use the following steps:

- Input 10,000 and press the FV key

- Input 10 and press the N key

- Input 6.5% and press the I/YR key

- Input 0 and press the PMT key

- Press the PV key to solve for the present value

Solve for Future Value on the HP 10BII

What will $100,000 invested today for 7 years grow to be worth if compounded annually at 5% per year?

To solve this problem simply identify the 4 known components and then use the HP 10BII financial calculator to find the 5th unknown component. In this problem we know the present value PV is -$100,000 because it’s what’s invested today. It’s negative because it’s leaving our pocket when we put it into the investment. The number of periods N is 7 years, and the rate I is 5%. The N and I components are both expressed annually, so they are consistent. Knowing this we can simply plug those 4 components into the calculator and solve for future value FV, which is $140,710.

- Input -100,000 and press PV

- Input 7 and press N

- Input 5% and press I/YR

- Input 0 and press PMT

- Press the FV key to solve for the future value

Solve for Payment on the HP 10BII

What are the monthly payments on a 30 year loan of $300,000 at a annual rate of 4.5% compounded monthly?

In this problem we are given the total number of periods N of 30 years, a present value PV of $300,000, an annual interest rate I of 4.5% compounded monthly, and because this is a loan amortized over 30 years, it is implied that the future value FV is $0. After a quick check it appears that the number of periods and the rate are actually expressed in different compounding periods, which of course presents a conflict. To resolve this let’s adjust the N and I components so they are both expressed monthly. We can convert the total number of compounding periods to 30 x 12, or 360 months and the rate to 4.5% / 12, or 0.375% per month. Now we have our 4 known components and can easily solve for the monthly payment amount, which is $1,520.

- Input 300,000 and press PV

- Input 360 and press N

- Input .375 and press I/YR

- Input 0 and press FV

- Press the PMT key to solve for the payment

Solve for Interest Rate on the HP 10BII

To solve for the interest rate, let’s take a look at a variation on the present value problem above.

A U.S. savings bond will be worth $10,000 in 10 years. If you paid $5,327 for it today, how much would you earn on an annual basis?

In this problem we know that the present value PV is $5,327 because that is what we are paying for the investment today. The future value FV is $10,000 since this is the lump sum we will receive in the future. Because it isn’t explicitly given, we know that the payment amount is implied to be 0. The number of periods N is given to us as 10 years. So, now we know 4 out of the 5 time value of money components and we can easily solve for the 5th unknown interest rate component, which turns out to be 6.5%

- Input -5,327 and press PV

- Input 10,000 and press FV

- Input 10 and press N

- Input 0 and press PMT

- Press the I/YR key to solve for the interest rate

Solve for Number of Periods on the HP 10BII

To solve for the number of periods, let’s take another variation of the present value problem above.

If you paid $5,327 for a U.S. Savings Bond today and earned 6.5% annually on your investment, how many years would it take for your investment to be worth $10,000?

In this problem we know that the present value PV is $5,327 because that’s what we are paying for the investment today. The interest rate is 6.5% annually because this is how much we earn each year. Finally, we know that the future value FV is $10,000 because this is how much the investment will be worth at some point in the future as it compounds. How far into the future? Well, now that we know 4 out of the 5 components we can simply plug them in and solve for N, which is 10 years.

- Input -5,327 and press PV

- Input 10,000 and press FV

- Input 6.5% and press I/YR

- Input 0 and press PMT

- Press N to solve for the number of periods

Conclusion

10bii Financial Calculator Training

In this article we showed you how to use a financial calculator step by step. We specifically focused on the HP 10BII and detailed how the calculator is organized, how to perform common calculations and functions, and finally we covered how to use the time value of money keys along with step by step examples. Additionally, we took a look at some common mistakes people make when learning how to use a financial calculator and we showed you how to avoid making these errors. Learning how to use a financial calculator is not a quick process and it does take time. There are many features of the HP 10BII that we did not cover in this article, but the elements we discussed will give you a solid foundation.