What is an HMO Plan?

A Health Maintenance Organization (HMO) health plan offers a local network of doctors and hospitals for you to choose from.

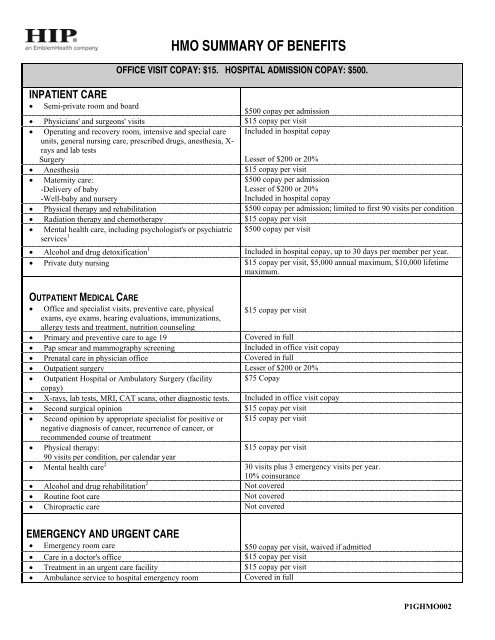

Each HMO plan includes global emergency and urgent care coverage* 24 hours a day, seven days a week.

$45 copay for nonformulary brand-name and generic drugs. Mail-Order $20 copay for formulary generic drugs. Up to a 31- to 90-day supply or 100 unit doses at participating pharmacies. $50 copay for formulary brand-name drugs.

If you choose a Cigna HMO or Cigna HMO Point of Service plan, it’s important to know the key features of both plans:

50% up to $200 maximum. For specialty drug information, see the federal plan brochure. Your plan requires the use of generic medication when a generic equivalent exists. Or get a 90-day supply for $20 for generics, 50% up to $400 max for brand name, 50% up to $600 max for nonformulary. Built-in Vision. Health Maintenance Organizations (HMOs) must provide you with the same benefits as Original Medicare but may do so with different rules, restrictions, and costs. HMOs can also offer additional benefits. Below is a list of general cost and coverage rules for Medicare HMOs. Remember to speak to a plan representative to learn the details about any plan you are considering.

- You will need to select an in-network primary care provider (PCP) for yourself and your covered dependents. You can change your PCP at any time.

- The PCP you choose will coordinate your health care needs and refer you to specialists as needed except for OB/GYN services. You don't need a referral for OB/GYN services. Cigna may need to pre-certify hospitalizations and other outpatient care, but there's no paperwork for you when using in-network providers.

For example, if you have a chronic health issue, you need to visit your PCP first. Your PCP may then refer you to an in-network specialist for care.

It’s also important to know they are different for out-of-network services:

Cigna HMO

If you get medical care outside of the plan’s network (such as a physician, hospital, clinic or pharmacy), those out-of-network services will only be covered if the treatment is considered emergency or urgent care as defined by your health plan documents.

Cigna HMO Point of Service

If you get medical care outside of the plan’s network (such as a physician, hospital, clinic or pharmacy), those out-of-network services may be covered but you will pay more out of pocket and you may need to file a claim.

Cigna HMO Open Access and Cigna HMO Point of Service Open Access

An HMO Open Access, or Health Maintenance Organization Open Access plan, is type of health plan that offers you flexible coverage along with tools and resources.

If you choose a Cigna HMO Open Access or Cigna HMO Point of Service Open Access plan, it’s important to know the key features of both plans:

- You have the option of choosing a primary care provider (PCP) to serve as your personal health advocate and coordinate your health care. It’s recommended, but it is not required.

- You don’t need referrals for in-network specialists however if you do see a PCP, they may refer you to a specialist after the initial exam. Cigna may need to pre-certify hospitalizations and other outpatient care, but there's no paperwork for you when using in-network providers.

It’s also important to know how they are different for out-of-network services:

Cigna HMO Open Access

If you get medical care outside of the plan’s network (such as a physician, hospital, clinic or pharmacy), those out-of-network services will only be covered if the treatment is considered emergency or urgent care as defined by your health plan documents.

Kaiser Hmo Copay

Cigna HMO Point of Service Open Access

Aetna Hmo Copay

If you get medical care outside of the plan’s network (such as a physician, hospital, clinic or pharmacy), those out-of-network services may be covered but you will pay more out of pocket and you may need to file a claim.